butler county kansas vehicle sales tax rate

If you have any questions about how Kansas sales and use tax laws apply to your business please visit the departments Policy Information Library on our web site wwwksrevenuegov or call the departments Taxpayer Assistance Center at 1-785-368-8222. A county-wide sales tax rate of 15 is applicable to localities in Butler County in addition to the 4 Alabama sales tax.

Sales Tax On Cars And Vehicles In Nebraska

Tax statements are mailed late November.

. Renew your vehicle tags online through the Kansas Motor Vehicle Online Renewal System. Some cities and local governments in Butler County collect additional local sales taxes which can be as high as 45. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees.

Vehicle Property Tax Estimator. Rates include state county and city taxes. 650 Is this data incorrect.

In order to be seen by a clerk- you will need to sign into the Q-Less line. You can start signing in to the line at 730 a. Kansas has state sales tax of 65.

The butler county kansas sales tax is 675 consisting of 650 kansas state sales tax and 025 butler county local sales taxesthe local sales tax consists of a 025 county sales tax. If you do not receive a tax statement by December 1 please contact our office at 316 322-4210. If you did not receive the forms in the mail you will need to visit the local County Motor Vehicle Office.

Ohio State Sales Tax. The second Monday of September every year the Bureau will conduct an Upset Sale. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle.

This is the first sale that a property must go through. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Learn how to renew motor vehicle tags.

Taxpayers have the option of paying personal property taxes in two halves. Tax payments must be received in our office by December 20 and May 10 to avoid interest. The 2018 United States Supreme Court decision in South Dakota v.

Find information on the mill levy or the tax rate that is applied to the assessed value of a property. The Butler County Sales Tax is 15. The Kansas state sales tax rate is currently.

You will need your renewal forms sent to you from the Kansas Department of Motor Vehicle to complete this process. Choose a search method VIN 10 character minimum Make-Model-Year RV Empty Weight And Year. Some cities and local governments in Butler County collect additional local sales taxes which can be as high as 13.

The mill levies are finalized in October and tax information is available in mid to late November. The Butler County Tax Claim Bureau participates in three kinds of sales on a yearly basis to consolidate the seated lands in the county for delinquent taxes. To review the rules in Kansas visit our state-by-state guide.

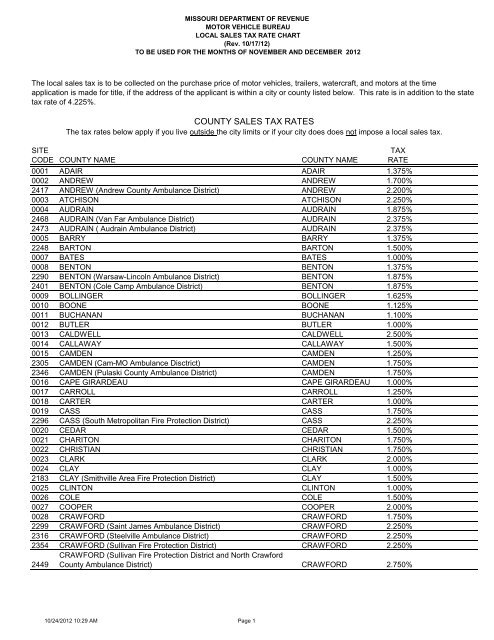

There are also local taxes up to 1 which will vary depending on region. Automating sales tax compliance can help your business keep compliant with. Missouri has 1090 cities counties and special districts that collect a local sales tax in addition to the Missouri state sales taxClick any locality for a full breakdown of local property taxes or visit our Missouri sales tax calculator to lookup local rates by zip code.

Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By. Find information on paying taxes. This table shows the total sales tax rates for all cities and.

A county-wide sales tax rate of 075 is applicable to localities in Butler County in addition to the 575 Ohio sales tax. The Butler County Sales Tax is 075. Has impacted many state nexus laws and sales tax collection requirements.

The latest sales tax rates for cities starting with A in Kansas KS state. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr. MOTOR VEHICLE BUREAU Motor Vehicle Sales Tax Rate Chart Updated 12102021 16250 17000 22000 TO BE USED FOR THE MONTHS OF JANUARY FEBRUARY MARCH 2022 The local sales tax to be collected on the purchase price of motor vehicles trailers watercraft and motors at the time application is made for.

Our Motor Vehicle offices utilize a line management system. If the first half personal property taxes. This may be done at either Butler County Motor Vehicle Office with the proper documentation and the payment of fees property tax and sales tax where applicable.

The first half is due December 20 and the second half is due May 10. The Butler County sales tax rate is. Tax statements are mailed late November.

Average Sales Tax With Local. Butler County Sales Tax. If you need access to a database of all Missouri local sales tax rates visit the sales tax data page.

Wichita KS 67218 Email Sedgwick County Tag Office. 15 rows The total sales tax rate in any given location can be broken down into state county city. If you do not receive a tax statement by December 1 please contact our office at 316 322-4210.

Search through information on properties in the county.

Ohio Sales Tax Rates By City County 2022

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Tax On Cars And Vehicles In Kansas

County Sales Tax Rates Missouri Department Of Revenue

Sales Tax In Alabama A Guide On The Alabama Sales Tax Rates For 67 Counties

Georgia Sales Tax Rates By City County 2022

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

My Local Taxes Sedgwick County Kansas

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Florida Sales Tax Rates By City County 2022

Which Counties Pay The Most Taxes In Kansas You Ve Probably Guessed Correctly Wichita Business Journal

Alabama Sales Tax Rates By City County 2022

Ohio Sales Tax Calculator Reverse Sales Dremployee